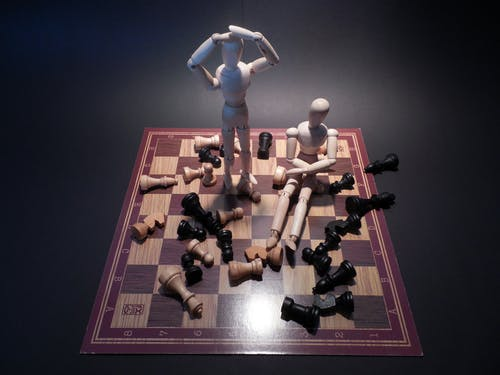

Why Did You Lose That Deal?

Every month I would analyze my closings and pre-quals, but the most important analysis I did was to determine why I did not get the deal—or why I lost the deal during processing/closing.

Was it due to interest rates? Closing costs? Real estate agent issues? No loan program? Clients did not qualify? The property did not appraise? Basically, ANYTHING that resulted in losing the deal from inception up to not getting the loan to the closing table!

This was absolutely the most valuable part my success.

It forced me to figure out what my competitors were offering so I could learn how to sell “against” my competition. Maybe there was a loan program that should be added to the product line! And if the clients did not qualify, I would re-analyze the file to see if there was another way I could have made it work (by the way, we probably saved at least one deal a month by having another person/UW/manager review the file).

What I also found was that in some instances, I did not set up the “expectations” of what the clients could expect during the processing and closing of the loan. That’s one of the reasons I wrote the e-Book called Little Book Of Mortgage Scripts that diva members can download free here. [Not a diva? Purchase the e-Book here for $37. Or become a member and gain free access to several e-Books!]

Keeping track of how you were able to land the deal—and how you “lost” a deal—is an invaluable snapshot (over a period of time) that can help you improve your saleswomanship and learn more about your competitors.

So, I’d like to challenge you to analyze all of your business (in process, closed loans, lost deals) over the last 90 days.

- What is the number of “possible deals” versus “loan applications”?

- How did you get the deals in the door?

- If clients did not complete a loan application, why did they not do business with you?

- If client’s loan did not close, why?

It’s difficult to think you are being rejected, but this also forces you to ask the tough question as to “why”!

However, taking time to do this exercise will help you become a better loan officer, and you will close a higher percentage of your deals!